Gold & Precious Metals IRA

IRA & 401k Backed by Gold Coins and Precious Metals

“Paper money eventually returns to its intrinsic value Zero”

– Voltaire

- Discover Why More Experts are recommending a physical gold and precious metals component of 5% – 25% of your total portfolio.

- Wall Street wants you to speculate on gold. Not Own It.

- Learn How Gold Can Be your Portfolio Insurance Policy.

- Third Largest Insurer Buys Gold for the first time in company’s 152 years history.

- Nobel Prize Winner In Economics Recommend Tangible Assets as part of Properly Diversified Portfolio.

The demand for precious metals in self-directed U.S. IRAs is growing for the same reasons other investors have been drawn to gold, platinum and silver.

- A Hedge Against Inflation

- Dollar weakness & Currency Fluctuation

- Credit-Market Worries

- Rising Interest Rates

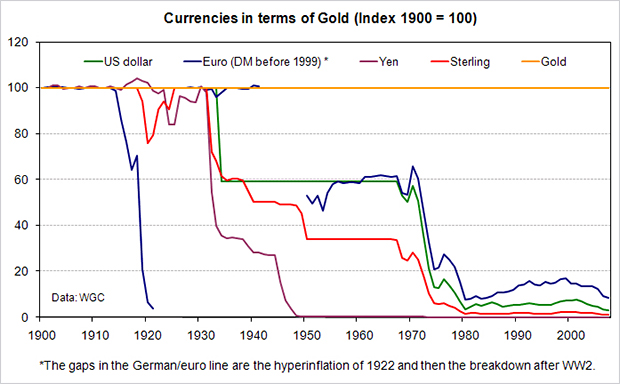

- Global Economic Turmoil & Unrest

More and more, individuals and institutions are placing physical gold and precious metals in IRA accounts. With the global economic environment growing increasingly uncertain, gold has become one of the leading alternatives for IRAs, 401(k), and Pension Plan preservation.

More and more, individuals and institutions are placing physical gold and precious metals in IRA accounts. With the global economic environment growing increasingly uncertain, gold has become one of the leading alternatives for IRAs, 401(k), and Pension Plan preservation.

Gold is the ultimate investment vehicle and has been purest form of money for centuries. It is also the most durable wealth-preserving asset on the planet. Unlike paper currencies governments can’t devalue it and has a limited and finite supply. This is why gold has survived every economy in history and has preserved purchasing power for more than 5000 years.

If you had purchased $25,000 of gold bullion coins in the early 70’s and held on to them during the oil crises, inflation, devaluation of the U.S. dollar, the Savings and Loan scandal, recession, the tech and internet bubble, cooked books, 9/11, and a real estate bubble, you could sell that gold today for $524,999.00.

If you had purchased $25,000 of pre 1933 limited mintage gold coins over the same timeline that value would be approximately $1,377,257.00.

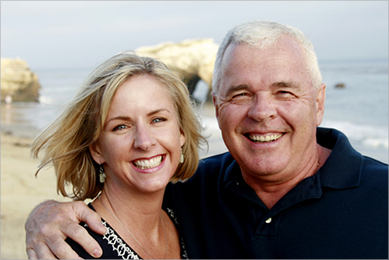

The value of gold, in terms of the real goods and services that it can buy, has remained largely stable for many years. In 1900, the gold price was $20.67/oz, which equates to about $503/oz in today’s prices. In the two years to end-December 2006, the actual price of gold averaged $524. So the real price of gold changed very little over a century characterized by sweeping change and repeated geopolitical shocks. In contrast, the purchasing power of many currencies has generally declined.

Legacy Coins & Capital can assist you with establishing your Precious Metals IRA account. Many of our clients’ wealth has increased as the performance of their physical gold and certified PCGS & NGC rare coin investments well outperformed most traditional investment accounts. Since 2001 gold has increased in value more than 300%. Considering the current economic turmoil, it would be a prudent decision to transition a portion of your IRA portfolio so it can have the protection of precious metals which has a proven track record of growth and asset protection.

Legacy Coins & Capital is one of the largest coin dealers in the US, with over 38 years of experience in the precious metals market place. We have earned an A+ rating from the Better Business Bureau and other industry affiliations. We possess the professional acumen to guide and advise our clients in all areas of precious metals and coin portfolio construction. We maintain a multi-million dollar diverse inventory of PCGS and NGC Certified Coins. We are a full service firm and are always looking to repurchase coins to replenish our inventory and accommodate the needs of our new and existing clients, whether buying or selling. Please let us know if you have any questions or concerns pertaining to a gold or precious metals strategy for your retirement IRA.

Establishing a Precious Metals IRA

Since 1986, investors have been allowed to invest their retirement funds in precious metals and bullion products, including American Eagle gold and silver coins. Since the new millennium the wisdom of this practice has become increasingly obvious.

Since 1986, investors have been allowed to invest their retirement funds in precious metals and bullion products, including American Eagle gold and silver coins. Since the new millennium the wisdom of this practice has become increasingly obvious.

Many investors are unaware of the multitude of asset classifications which should be included in a properly diversified portfolio to offset market volatility. With prospects of higher inflation, the US Government deficits at record highs, investor confidence near an all time low and many retirement investments locked into vulnerable paper promises, all of which could erode retirement savings. Now may be the ideal time for Legacy Coins & Capital to assist you in rolling over a portion of your current IRA in to or establishing a new self directed Precious Metals IRA.

An IRA portfolio constructed with an appropriate mix of stocks, bonds, cash equivalents, and precious metals, can help maximize the return of that portfolio, while limiting the natural swings of the economy.

Many experts say that when precious metals and rare coins were included in diversified portfolios, they increased overall return and reduced risk.

Retirement planning isn’t just about saving money. It’s about diversifying and insuring your portfolio assets to avoid economic erosion and to maximize the return while limiting the natural swings of the economy. The following are some of the challenges you could avoid by adding precious metals to your retirement planning.

|

|

|

IRA/401K Roll-Over Options

Chart your own course with a self directed IRA, you make the decision to rollover your IRA, 401k or 403b, and maintain the tax-deferred benefits while avoiding taxes and penalties. Additionally, with a self directed retirement plan, you will have options which will allow you to personally manage your money. There are no penalties or tax consequences for modifying your IRA into a self directed precious metal IRA or 401k Plan. (Consult your financial advisor and or Tax Consultant regarding your specific circumstances).

Transfer or Rollover?

Your first alternative is a “transfer.” This is something you can do at any time with your existing IRA, as long as the assets go “from custodian to custodian.” In a direct transfer, the money flows directly from one IRA custodian to another. This means the distribution check from the old IRA custodian must be made out in the name of the trustee or custodian of the new IRA account that receives the funds. Transfers may be made as often as you want. You can be assured that Sterling Trust Company has organized thousands of these types of transfers for clients.

Your first alternative is a “transfer.” This is something you can do at any time with your existing IRA, as long as the assets go “from custodian to custodian.” In a direct transfer, the money flows directly from one IRA custodian to another. This means the distribution check from the old IRA custodian must be made out in the name of the trustee or custodian of the new IRA account that receives the funds. Transfers may be made as often as you want. You can be assured that Sterling Trust Company has organized thousands of these types of transfers for clients.

The second alternative is a “rollover.” A rollover occurs when you receive the distribution from your existing IRA account and then turn around and deposit it in another IRA custodial account. In this case you would need to re-deposit the funds into the new IRA account within 60 days. If the 60 day time period is exceeded, you would be liable for taxes and penalties on the money withdrawn. You may roll over the same money only once every 12 months to preserve the tax-deferred status of your retirement savings.

Moving a Portion of your existing IRA to a Precious Metals Self-Directed IRA Is as easy as 1 2 3!

- Get the Precious Metals IRA PDF Brochure Download Here – right click save link as (Get Adobe Reader if you don’t already have it installed) or call 800.766.2780

- Once you receive the information feel free to call regarding the types of metals that can be included or if you have any questions regarding set-up forms for a Precious Metals Self-Directed IRA.

- Once the metals are placed into your account, you will have your own highly trained personal account representative who will guide and advise you every step of the way.

Permissible Precious Metals within a Sterling IRA Account

PERMISSIBLE PRECIOUS METALS IN A STERLING TRUST PRECIOUS METALS IRA

For several years only gold and silver legal tender U.S. American Eagle coins were allowed as IRA investments under the federal guidelines. However, legislation which took effect in 1998 expanded this to include gold, silver, platinum and palladium bullion which meets certain fineness standards. Through a lease arrangement with FideliTrade, Inc./Delaware Depository Service Company (DDSC), Sterling Trust is able to maintain physical possession of bullion coins and bars in a segregated account in a secure vault. Thus, through this relationship, Sterling Trust is able to accept and maintain custody of the following coins and bullion products:

*(1) Coins, including the American Eagle, that have undergone “certification” (also known as “slabbed” coins) are not acceptable in IRAs at this time.

*(2) Bars and rounds produced by manufacturers accredited by Nymex/Comex, LME, LBMA, NYSE/Liffe/CBOT, and ISO-9000 or a national mint.

*(3) The minimum fineness required for types of bars are as follows

Gold .995+, Silver .999+, Platinum .9995+, Palladium .9995+

GOLD

- American Eagle coins *(1)

- Australian Kangaroo/Nugget coins

- Austrian Philharmonic coins

- Canadian Maple Leaf coins

- Credit Suisse—Pamp Suisse Bars

- .999 U.S. Buffalo Gold Uncirculated coins *no Proofs*

- Bars and rounds as referenced Right *(2) *(3)

SILVER

- American Eagle coins *(1)

- Australian Kookaburra coins

- Austrian Vienna Philharmonic coins

- Canadian Maple Leaf coins

- Mexican Libertad coins

- Bars and rounds as referenced Right *(2) *(3)

PLATINUM

- American Eagle coins *(1)

- Australian Koala coins

- Canadian Maple Leaf coins

- Isle of Man Noble coins

- Bars and rounds as referenced Right *(2) *(3)

PALLADIUM

- Bars and rounds as referenced Right *(2) *(3)

Frequently Asked Questions

How can I open a Self Directed Precious Metals IRA?

Request a Free Precious Metals IRA information guide on how to open up an account either online by filling out your information at our contact form or by calling 800.766.2780. We can begin the process as soon as you contact us. An account executive will assist you through the entire process and answer any questions and address any concerns.

What types of precious metals are permitted within a Sterling IRA?

Please refer to Sterling’s Processing Checklist for Precious Metals for the specific coins and bullion that may be purchased and held in a Self Directed Precious Metals IRA. This how-to guide should answer most of your questions and help walk you through the process. Please contact us at 800.766.2780 for additional information.

Who’s the custodian of my Precious Metals IRA and what are their fees?

Sterling Trust Established in 1984 to provide quality administrative services for self-directed individual retirement accounts, qualified business retirement plans and personal custodian accounts, Sterling Trust Company currently administers accounts with assets exceeding $2 billion for clients in all 50 states. The company regularly complies with federal and state agencies overseeing regulatory compliance of directed trustees and custodians. In addition, Sterling is audited annually by the prominent accounting firm, Ernst & Young, and is annually examined by the Texas Department of Banking.

Sterling Trust prides itself in its superior customer service. Their representatives are fully trained, knowledgeable, and able to provide you a high degree of courteous service. You’ll receive quarterly account statements, and be provided with the necessary government reporting. It’s like having your own personal, professional administrative staff responding to your directions. For this superior brand of service, you’ll be charged a nominal annual custodial fee of $65.

Where will the metals be physically stored?

Sterling Trust has chosen Delaware Depository Service Company as its precious metals depository for the storage of metals on behalf of its clients. The depository offers a secure safekeeping service and provides easy access for the physical delivery of precious metals. The Sterling Trust account is charged a safekeeping fee of $100 annually for the precious metals storage fee. This fee is based on a calendar year and the depository does not prorate fees.

DDSC was approved by the Commodity Futures Trading Commission as a licensed depository of the New York Mercantile Exchange (NYMEX) for platinum and palladium storage, and the New York Commodity Exchange (the COMEX Division of NYMEX) for silver storage. DDSC is also licensed by the NYSE-LIFFE (Previously the Chicago Board of Trade) to store silver for its member companies and their customers.

Customer assets are stored in high-security vaults located in Wilmington, Delaware. Vaults are constructed and maintained in compliance with the Bank Protection Act and UL standards. To supplement experience, physical security and internal controls, DDSC maintains $300,000,000 in “all-risk” insurance coverage.

Who is eligible to make IRA contributions?

Generally, anyone under age 70½ (seventy and a half) who earns income from employment, including self-employment, can make annual contributions to an IRA.

How much may I contribute to my IRA annually?

You can contribute a maximum of $5,000 (plus a catch-up contribution of up to $1,000 for individuals age 50 and over) or 100% of your compensation, whichever is less, to an IRA each year. SEP Plans and Pensions have higher limits.

If I already have an IRA or other retirement accounts, can I transfer all or a portion of those proceeds to a Precious Metals IRA?

Absolutely. You simply complete the Precious Metals IRA forms and transfer any portion of your existing Retirement accounts you wish.

What is a direct rollover?

A direct rollover is a distribution from your employer retirement plan which is sent to your IRA or another employer retirement plan. The 20% withholding is not imposed on a direct rollover.

When can I start withdrawing distributions from my IRA?

You can begin withdrawals at age 59 1/2. Except for certain circumstances, any funds you withdraw before that date are subject to a 10% penalty.

You must begin withdrawals at age 70 1/2. For Roth IRAs, after five years, you may withdraw funds tax-free and penalty-free before age 59 1/2 for a first-time home purchase or to pay college costs. Further, you don’t have to begin withdrawals from a Roth IRA when you reach age 70 1/2

How liquid is an investment in Precious Metals or Rare Coins*?

Investment grade numismatic coins are extremely liquid. In fact, certified PCGS and NGC rare coins are actively traded over an international coin exchange with established bid and ask prices. As a result, individual components or an entire numismatic investment portfolio can be liquidated at any time with the proceeds of the sale available almost immediately. Legacy Coins & Capital is a full service firm buying selling and trading. We work with our clients from inception until successful liquidation.

*Rare coins not acceptable for IRA or 401(k) plans

How will the precious metals be valued?

The valuations reflected on your Precious Metals IRA account are estimated values and should be used as an indication only of the precious metal value. Estimated values do not include any dealer mark-ups, mark-downs or commissions. Proof coins must be encapsulated in complete, original mint packaging, including certificate of authenticity, and in excellent condition. Non-proof coins must be in Brilliant Uncirculated condition and free from damage.

How do I purchase precious metals once my Sterling Trust account is open?

Once Sterling Trust receives all the completed and signed forms and payment of fees they will send the Transfer Request/Direct Rollover Letter to the resigning custodian. After the account receives the transfer of funds and has the necessary funds available, the account holder should place their precious metals purchase order with the precious metal dealer of their choice. Once the purchase order has been placed, Legacy Coins & Capital will fax or email the invoice to Sterling Trust which specifies the type and quantity of coins purchased and the respective purchase price. (The invoice should be signed by the account holder) Once payment is sent to the precious metal dealer, they will ship the purchased metals to Delaware Depository Service Company. The depository will send a confirmation to Sterling upon its receipt of the precious metals delivered on behalf of the account holder. Upon confirmation of the depository’s receipt of the precious metals, the metals will be appropriately posted to the client’s account.

Call us toll free at 800.766.2780 and speak to one of our Account Specialists today!